Property tax increases were considered modest in King County for the 2022 tax year -- about 3 percent in general; 5.88% for Shoreline and 7.73% for Lake Forest Park – despite the fact that property values rose by about 9 percent.

This is because voter approved levies, and not rising property values, are the main drivers of property tax increases.

By state law, values are set as of January 1 each year. Taxes collected this year are based on the value of the property on January 1, 2021.

Overall, countywide property tax collections for the 2022 tax year are $6.79 billion, an increase of $190 million --3% -- over last year’s total of $6.6 billion. Total County property values, however, increased by more than 9%, from $ 659.5 billion to $722.5 billion

Overall, countywide property tax collections for the 2022 tax year are $6.79 billion, an increase of $190 million --3% -- over last year’s total of $6.6 billion. Total County property values, however, increased by more than 9%, from $ 659.5 billion to $722.5 billion

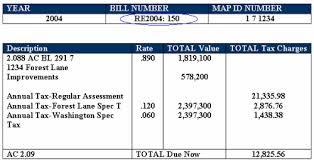

Tax Change 2021 vs 2022

City: Shoreline

Roll Year: 2021

Median: 534,000

Levy Rate: $ 11.79380

Taxes: $ 6,297.89

Roll Year: 2022

Median: 625,000

Levy Rate: $ 10.66872

Taxes: $ 6,667.95

Increase: 5.88%

Click here for a spreadsheet showing the changes by city for all of King County:

“Residential property values have continued to rise during the COVID 19 pandemic, partly driven by a lack of housing inventory,” said King County Assessor John Wilson.

“Still, it is important to remember that voter approved levies, and not the value of your property, is the primary cause of increased property taxes. Local governments may only increase property tax collections by 1% per year without a vote of the people. Voter approved levies are not subject to that restriction.”

Property taxes vary depending upon location, the assessed value of the property, and the number of jurisdictions levying taxes (such as state, city, county, school district, port, fire district, etc.).

King County Treasury has begun sending out tax bills. King County collects property taxes on behalf of the state, the county, cities, and taxing districts (such as school and fire districts) and distributes the revenue to these local governments.

About 57 percent of property tax revenues collected in King County in 2022 pays for schools. Property taxes also fund voter-approved measures for veterans and seniors, fire protection, and parks. King County receives about 17 percent of your property tax payment for roads, police, criminal justice, public health, elections, and parks, among other services.

For seniors and the disabled, it is important to be aware of our state’s property tax relief programs. King County taxpayers who are 61 years or older, or disabled, own their home, and have an annual income of $58,423 or less after certain medical or long-term care expenses, may be eligible for tax relief.

Taxpayers should visit this site: https://www.kingcounty.gov/depts/assessor/TaxRelief.aspx for more information and to apply online.

Property owners can find tax levy rates and more property related information by visiting the eReal Property Search on the King County Assessor’s website or by calling 206-296-7300.

Property owners can find tax levy rates and more property related information by visiting the eReal Property Search on the King County Assessor’s website or by calling 206-296-7300.

No comments:

Post a Comment

We encourage the thoughtful sharing of information and ideas. We expect comments to be civil and respectful, with no personal attacks or offensive language. We reserve the right to delete any comment.